Laboratory Purchasing Trends

How is the current state of the economy influencing purchasing and investment plans for labs?

The new year is approaching and with that comes renewed strategies to achieve annual objectives. The decisions around budgeting and prioritization of investments are key for lab managers to achieve these goals.

In Lab Manager’s 2023 Fall Purchasing Trends Survey, we asked nearly 150 laboratory leaders to share their perspectives on the types of investments they intend to make in the coming year and how these decisions have evolved from prior years. The responses help to identify trends and challenges across the industry and enable you to see how your lab’s plans compare to others.

Who was surveyed?

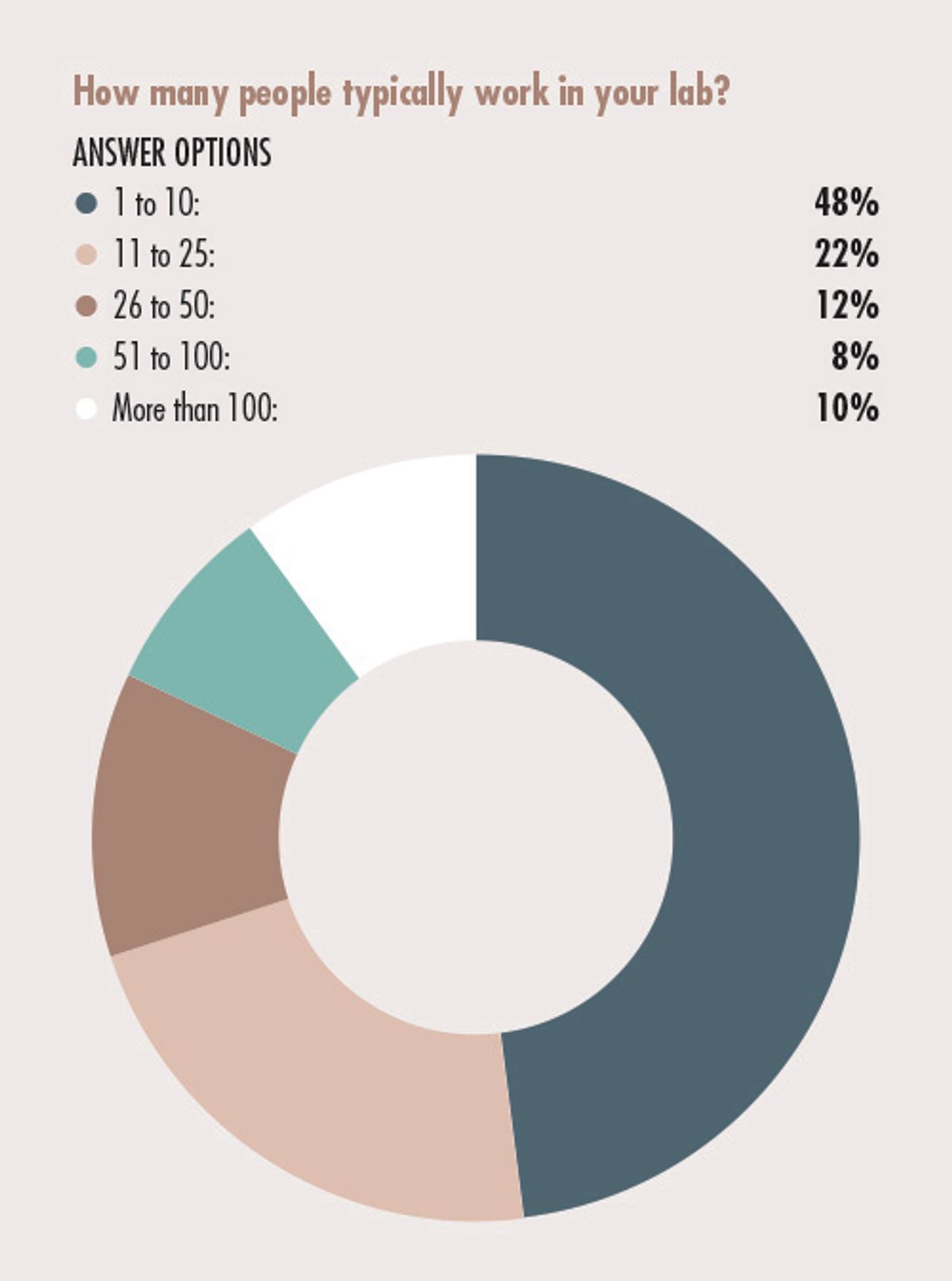

Survey participants hold a variety of decision-making roles, such as lab manager, supervisor, director, and principal investigator, among others. Participants represent academic, government, and industry labs. In fact, about one-third of respondents represent academic labs (universities or colleges). Other common organizations include clinical labs and hospitals/medical centers, environmental labs, manufacturing facilities, contract research labs, and laboratory consulting firms.

Stability versus expected changes

A core section of the survey focused on budget changes year over year across a variety of categories—from purchasing consumables, supplies, and raw materials to funding for new projects and modernizing the lab to staff needs like hiring, training, and travel to conferences or trade shows.

When asked to compare 2023 to previous years, participants noted that their budgets have remained relatively stable in most categories, but there was evidence of cuts or lean spending in a few key areas, such as staffing. When asked about “hiring additional and replacement staff” in 2023 compared to the previous year, about 26 percent indicated a decrease in budget for hiring. “Funding for new projects” also saw a decrease in budget for 26 percent of respondents, suggesting that growth and expansion for many organizations may have been paused this year to conserve funds as many experts believed a recession loomed in the US.

However, looking ahead to the next 12 months, the survey data shows a shift in mindset and willingness to spend again in these categories. For example, about 40 percent of participants anticipate that their budget will increase in 2024 for new or existing projects, and 35 percent envision an increase for investments in new and pre-owned lab products.

Circling back to the “hiring additional and replacement staff” question for 2024, the number of participants who expect a decrease in budget drops to 18 percent while 30 percent anticipate an increase in budget. Other categories that will see an increase in 2024 that weren’t as prevalent in 2023 include “modernizing existing lab facility” and “staff education and training.” These results further support the notion that many labs are looking to grow and make strong gains in the upcoming year.

Factors that influence purchasing decisions

For the organizations that are aiming to fund new projects or grow existing ones, the equipment purchasing process will prove vital to ensuring the lab is equipped with the right tools to enable the work. Another key section of the survey polled participants’ opinions on how they value certain criteria when making a purchasing decision.

As expected, the top consideration is the price and value of a vendor’s products (88 percent viewed this as “very important”), followed by after-sale support, maintenance, and warranty with nearly 80 percent of participants noting this as “very important.” Compatibility and user-friendly software also ranked high on the list, whereas one-third of respondents thought “extra features available” was a strong factor.

| Top 5 Factors When Purchasing Lab Products and Services |

| 1. Price/value of vendor's products |

| 2. Long-term efficiency and operating costs |

| 3. Post-sale support, maintenance, and warranty |

| 4. Compatibility with lab's current systems |

| 5. Vendor representative's knowledge of industry and technology |

These results demonstrate the importance of choosing not just a suitable product but the right vendor partner for your lab who can provide industry insight, advice, and ongoing support. Lab managers should ask potential vendors about their approach to working with labs post-sale and what additional value they can bring to help the lab meet their goals beyond providing a sophisticated, intuitive instrument.

Lab services

An additional area of focus for this year’s survey was lab services. Managers must make the same types of decisions about services as they do for products. Some of the services that participants plan to purchase “as soon as possible” include:

- Equipment calibration, inspection, maintenance services

- Training

- Recruiting staff

- Accreditation, certification, and compliance services

Other services planned for the next 12 months include lab monitoring and data management. Outsourcing or enlisting external help to fulfill tasks within the lab can result in a variety of benefits and potentially free lab staffs’ time to focus on processes that align with their area of expertise.

Key observations

Despite conservative budgeting within some key areas in 2023, expectations for 2024 signal a rebound in investment, particularly in projects, staffing, and facility modernization. Survey results emphasize the significance of vendor partnership, focusing on product value, support, and compatibility. Additionally, the survey highlights the growing inclination toward outsourcing services such as equipment maintenance, training, and compliance, signifying a trend toward optimizing internal resources for higher productivity and proficiency within laboratories.